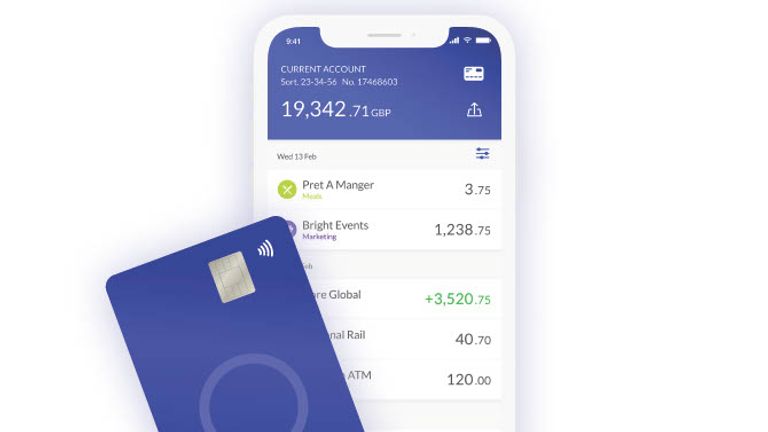

Tide, the business banking services platform, is on the verge of achieving a $1bn valuation through a forthcoming share sale. The company, founded in 2015 and chaired by Sir Donald Brydon, is reportedly arranging the sale of existing shares at a premium of approximately 30% compared to its most recent funding round in 2021. Sources indicate that the secondary share sale is in advanced stages and could be finalized soon.

Tide, which is not a bank itself but partners with Clearbank to offer business banking services, has garnered a customer base of 575,000 small and medium-sized businesses, with an additional 200,000 in India. This increased valuation is noteworthy given the current challenges faced by many technology businesses in raising new funding or securing reduced valuations.

Among Tide’s existing shareholders is Apax Digital Fund, which is reportedly eager to increase its stake. Other prominent backers include Augmentum, a London-listed fintech investor. As part of the share sale, approximately 10% of Tide’s equity is expected to change hands, allowing early investors to cash out.

Tide declined to comment on the matter.